w.m.o/r

32

Released August 2007

CDr edition of 200

Stock

Exchange Piece

(Gold &

Light Sweet Crude Oil)

Matthieu

Saladin

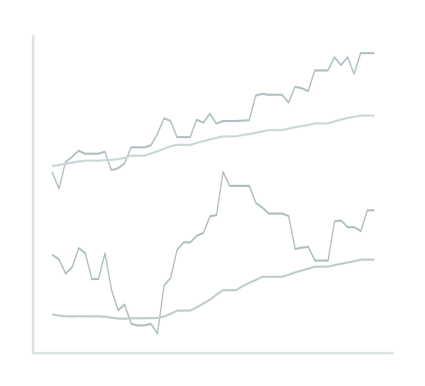

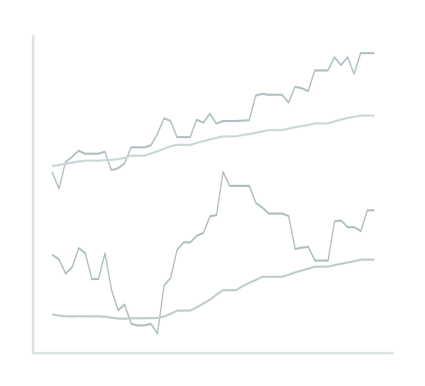

The Stock Exchange Pieces are

transpositions of rates and index of the Stock Exchange to sine waves,

with simple substitution of units. The rates fluctuations determine the

swings of resulting frequencies.

In this piece, the rates of oil

and gold and their respective 50-day moving averages (MA 50) usually

associated with them are transposed to sine waves by simply swapping

units. For example, if the oil barrel is worth 61.43 USD, the frequency

of the sine wave will be 61.43 Hz; for gold, if its index is at 648.05

USD/ounce, the frequency of the sine wave will be 648.05 Hz, etc. Thus,

the swings of high frequencies correspond to fluctuations of gold and

its MA 50 and the swings of low frequencies to fluctuations of oil and

its MA 50.

The considered period is 50

days (from March 4 to April 22, 2007) so that the moving average of the

last index is calculated from all the individual values heard during

the piece. The ratio for duration is 1 day is equal to 1 min, thus the

piece lasts 50 min. The index/frequencies are separated in pan,

according to the following distribution: rates of gold and oil on the

left, MA 50 on the right.

The sine waves move about,

converge or move away from each other, mirroring oscillations of the

Stock Exchange and thus generating acoustic phenomena in their movement

– sonic transcription of a flow.

Instrument: sine wave generator

Recorded April 22, 2007

French:

Stock

Exchange Piece

(Gold &

Light Sweet Crude Oil)

Les Stock Exchange Pieces sont

des transpositions en fréquences, par simple substitution de

l’unité, des taux et indices de la bourse. La variation des

indices détermine la variation des fréquences

résultantes.

Dans cette pièce, il

s’agit des transpositions en fréquences des indices de l’or et

du pétrole, ainsi que de leur moyenne mobile respective sur 50

jours (MA 50) telle qu’elle leur est habituellement associée

dans la présentation des cours. Par exemple, si le baril de

pétrole est à 61.43 USD, la transposition en

fréquence égale 61.43 Hz ; même chose pour

l’or, si son indice est à 648.05 USD/once, la transposition en

fréquence égale 648.05 Hz, etc. La variation des

fréquences aigues correspond ainsi à celle de l’or et de

sa MA 50 et la variation des fréquences basses à celle du

pétrole et de sa MA 50.

La période

considérée s’étend sur 50 jours (du 04/03/07 au

22/04/07) afin que la moyenne mobile du dernier indice soit

calculée sur la base de l’ensemble des indices qui se sont

succédés lors de l’écoute. Rapport de durée

adopté : 1 jour = 1 min. La pièce dure donc 50 min. Les

indices/fréquences sont séparés dans le

panoramique, selon la répartition suivante : taux de l’or

et du pétrole à gauche, MA 50 à droite.

Les fréquences

évoluent, se rapprochent ou s’éloignent les unes des

autres au gré des oscillations du marché et engendrent

ainsi dans leur mouvement des phénomènes acoustiques –

transcription sonore d’un flux.

Instrument :

générateur de fréquences

Enregistré le

22/04/07

Contact :

matthieu.saladin[at]wanadoo[dot]fr

Reviews:

============

VITAL WEEKLY

============

number 591

---------------------

week 35

---------------------

The good thing about not having money, is that one doesn't have

to worry how to make more money. I am not sure if Saladin has

money, or shares, but the stock market is the starting point for

his 'Stock Exchange Piece'. He took the rates of oil and gold

over a fifty day period, and 'translated' the fluctuations into

sine waves. So if the rate is 61.43 dollar for a barrel of oil

today, then he will pick that as frequency in sinewaves and with

the gold it's dollars per ounce (oil becomes low frequencies and

gold higher frequencies). Each day, one minute. There is a bit

which I don't understand about the 'moving averages' (MA50), but

alas I can't be economic about that. That's about it. The result,

one might ask, any good? Yes it is. The fluctuations don't jump

around a lot, but it moves up and down, and slow as it is, the

piece moves up and down in a slow. A great slow, heavy drone piece.

Frans De Ward

TOUCHING EXTREMES (Italy)

One of my most pronounced cultural limits (…alright, "culture" is an

unrecognized concept here, but let's just pretend it exists…) is the

comprehension of the mechanisms at work in the Stock Exchange market,

something which "real world" occurrences depend on, and yet I never

cared a

iota about that. Furthermore, every time I look at those sharp-dressed

operators chocking themselves while performing their specialist

language of

signs, my mind decrees that pigeons could very well be designing our

future

political and economic developments. Now, Matthieu Saladin found a way

for

this man to appreciate at least a smidgen of Stock Exchange behavioural

implications. He associated different frequencies of sine waves to the

rates

and indexes of gold and light sweet crude oil, then proceeded to

generate an

electronic composition out of their fluctuations. One would expect a

sonic

mayhem akin to a Wall Street chaos of bleeps, purrs and mumbles, right?

Wrong. What's left is a simple parallelism of high and low pulsating

undulations, whose interior movement accelerates or decelerates in a

gradually evolving pseudo-immobility. Picture a much colder, less rich

version of Eliane Radigue's "Trilogie de la Mort" and you'll get a vague

idea of how this stuff sounds like. A little more dope in the

reproduction -

speakers are mandatory - and the oscillating pulses become strikingly

muscular, resounding presences all around the house, thickness varying

depending on the position we're in. Very installation-oriented,

intelligently minimal. And you don't even need an Armani suit to enjoy

it

Bagatellen (USA)

Mathieu Saladin

Stock Exchange Piece (Gold & Light Sweet Crude Oil)

w.m.o/r

32

Saladin was responsible for a

favorite recording of mine from the

last couple of years, “Intervalles” on l’Innomable, a penetrating set

of processed reed improvisations. This is different. And puzzling.

Using a methodology you can read for yourself on the label site, he

basically transposes the values of gold and crude oil over a 50-day

stretch into corresponding sine wave units. One day equals one minute

of disc time, replete with resultant fluctuations as the two sets of

waves intertwine. It’s intriguing, not to say provocative, to use a

source like this to generate such a pure “object”. It may also be

problematic that there’s certainly no way for the listener to have

known the source unless informed outside of the sounds themselves. A

demonstration of the abstract nature of capital? An illustration of the

insubstantiality of the global marketplace? There are, after all, any

number of more or less random processes Saladin could have used aside

from those he chose. Listened purely as sound (something I find a bit

uncomfortable to do, given what I know), the piece quavers mightily

(sporting some nice bass) over its course though with little overall

change aside from a quickening or slackening of the throb. Indeed, by

moving oneself a couple of feet, the listener effects far greater

change than is otherwise heard throughout. One can, interestingly,

almost eliminate the bass at certain physical points.

Ultimately, I enjoyed it. Art’s

been made from gold and oils for a long time now, after all.

Posted by Brian Olewnick on November 14, 2007 5:57

PM

Massimo

Ricci

Testcard #18 (Deutschland, by Magnus Schaefer)